Loan Raptor

Loan Raptor stands as a pivotal online marketplace designed to bridge the gap between borrowers and a diverse network of credible lenders. Our mission is to facilitate the acquisition of loans that cater to various financial situations, providing a reliable, transparent, and efficient borrowing experience. Whether you require urgent cash for unexpected expenses or need a substantial loan for major purchases, Loan Raptor guides you towards the right financial solutions with precision and dependability.

Key Features of Loan Raptor

1. Robust Security Measures: We prioritize your privacy and security by employing advanced encryption technologies to safeguard your personal data.

2. Comprehensive Lender Network: Gain access to a wide array of lenders who offer customized loan products with competitive terms.

3. Quick Processing & Approval: Experience our streamlined application process that ensures quick reviews and fast approvals.

4. High Approval Rates: We specialize in assisting applicants with diverse credit histories, maximizing your chances of approval.

Why Choose Loan Raptor?

Opting for Loan Raptor means selecting a service that is committed to your financial well-being. Reason foe Choosing A Loan raptor is:

1. Personalized Loan Matching: We leverage advanced algorithms to connect you with lenders that best meet your financial profile and needs, ensuring a tailored borrowing experience.

2. Wide Range of Loan Options: Whether you need quick cash for an emergency or a substantial loan for a major purchase, our vast network of lenders offers a diverse range of options.

3. Fast and Efficient Process: Our streamlined application process allows for quick submission, evaluation, and response, helping you secure funds swiftly when you need them most.

4. High Approval Rates: Our platform is designed to assist borrowers with various credit histories, increasing your chances of loan approval even with less-than-perfect credit.

5. Security and Privacy: We prioritize your privacy with top-level encryption and security measures to protect your personal and financial information from unauthorized access.

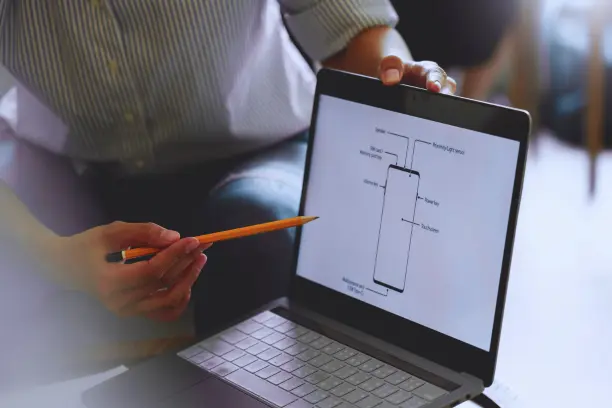

How Loan Raptor Works

- Step 1: Submit Your Application Start your loan journey by visiting Loan Raptor’s user-friendly website. Here, you can fill out a simple online application form, providing necessary personal and financial details. This step sets the foundation for matching you with the right lender.

- Step 2: Get Matched with Lenders Once your application is submitted, Loan Raptor’s advanced algorithm processes your information to find the most suitable lenders from our extensive network. This matching is based on your specific needs and profile, ensuring a personalized selection of loan offers.

- Step 3: Review Offers and Select You’ll receive multiple loan offers tailored to your situation. Take your time to compare interest rates, repayment terms, and other critical loan conditions. This transparency allows you to make an informed decision on which loan offer best suits your financial goals and capabilities.

- Step 4: Finalize and Receive Funds After selecting the best loan offer, you’ll finalize the agreement directly with the lender. Complete any additional requirements and sign the loan agreement. Once everything is set, the lender will disburse the funds directly to your bank account, often as quickly as the next business day.

Different Types Of Loans We Serve

Easy Cash Loan

A payday loan is a short-term, high-interest loan typically used to cover immediate expenses until the next payday. These loans are known for their quick approval and disbursement processes. They often do not require a credit check, making them accessible to many borrowers. However, due to their high interest rates, they are best used sparingly and with caution.

Personal Loan

Personal loans are unsecured loans that provide higher borrowing amounts and longer repayment terms than payday loans. They are commonly used for consolidating debt, financing big purchases, or covering significant expenses like home renovations. Personal loans often require a credit check and offer competitive interest rates based on creditworthiness.

Installment Loan

Installment loans allow borrowers to repay the loan amount plus interest in scheduled payments, typically monthly. These loans are suitable for those who need substantial amounts with a more manageable repayment plan. Installment loans can be secured or unsecured and are used for a variety of purposes, from buying vehicles to funding education.

Emergency Loan

Emergency loans are designed for urgent financial needs, such as unexpected medical bills, car repairs, or immediate home repairs. These loans are prized for their quick approval and rapid fund disbursement. Emergency loans help bridge the financial gap during crises, often requiring fewer borrower qualifications to expedite the lending process.

How to Apply for Loan Raptor

To apply for a loan with Loan Raptor, simply:

Step 1: Once approved, review the loan agreement and accept the terms to get your funds.

Step 2: Navigate to our website and select the desired loan type from the available options.

Step 3: Fill out the application with your personal and financial details.

Step 4: Submit your application and receive a decision within minutes.

Diverse Options for Securing Loans from Direct Lenders

1. Easy Cash Loan: These loans are characterized by their simplicity and speed, providing borrowers with a hassle-free application process and quick disbursement. Easy Cash loan Ideal for less significant but urgent financial needs, they often come with flexible repayment terms and minimal background checks.

2. Tribal Loans Direct Lender Guaranteed Approval No Teletrack: These loans provide a fast financing solution without traditional credit tracking, making them suitable for those with privacy concerns or unique borrowing needs. Tribal loans Ideal for applicants facing credit challenges, these loans offer rapid approval and funding directly from tribal lenders under sovereign immunity.

3. 1 Hour Payday Loans No Credit Check: Designed for urgent financial crises, these loans ensure that funds are disbursed quickly, typically within an hour, without the need for credit checks. 1 Hour Payday loan is a viable option for those needing immediate cash relief without the hassle of lengthy approval processes.

4. $300 Dollar Loan: Small but effective, this loan type is perfect for covering sudden expenses like medical bills or car repairs. It offers a straightforward, short-term financial solution with fast processing and minimal eligibility requirements, making it easier to manage unexpected costs efficiently.

How Safe Are Loans from Loan Raptor for Me?

Your security is our top priority at Loan Raptor. We utilize state-of-the-art security protocols to ensure all your data is protected from unauthorized access. Our lending partners are carefully selected based on their reputation and commitment to ethical lending practices, ensuring that you receive not only financial support but also peace of mind.

Advantages and Disadvantages of Loan Raptor

Advantages:

- Accessibility: Loan Raptor provides easy access to a variety of loans, making it convenient for users with different financial needs and credit backgrounds to find suitable options.

- Speed: The platform is designed for quick processing, from application to matching with lenders, allowing borrowers to receive loan offers and funding in a timely manner.

- User-Friendly Interface: The website is straightforward and easy to navigate, ensuring that users can easily apply for loans without confusion

Disadvantages:

Higher Interest Rates: Due to the nature of some of the loans offered, particularly payday loans and loans available to individuals with poor credit, interest rates can be higher than those offered by traditional banks.

Potential for Debt Cycle: Easy access to quick loans can lead borrowers to take on more debt than they can manage, potentially leading to a cycle of debt if not managed properly.

Fees and Penalties: Borrowers need to be aware of any additional fees or penalties associated with late payments or non-compliance with the loan terms, which can add to the cost of borrowing.

FAQs

Q1: How quickly can I receive funds after being approved?

Funds are generally available within one business day after approval, depending on the lender and your bank’s processing times.

Q2: Are there any upfront fees for applying through Loan Raptor?

No, Loan Raptor does not charge any upfront fees for applying. Any fees associated with the loan will be determined by the lender.

Q3: Can I apply for a loan if I have poor credit?

Yes, Loan Raptor offers options for borrowers with various credit histories, including those with poor credit.

Q4: Is my personal information safe when applying with Loan Raptor?

Yes, we use advanced encryption and security measures to protect all personal and financial information you provide.

Q5: Can I repay my loan early?

Yes, many lenders allow early repayment without penalties, but it’s important to confirm this option with your specific lender before accepting a loan offer.